In this line of thought, you should know that transaction limits are just as convenient, even for the high-rollers out there. An even happier circumstance is the lack of fees – individuals are not charged anything for using the service, while businesses listing it as a payment option face only minute costs of 1.5-2SEK.

Normally, transactions are performed in real time, as soon as you confirm it via Mobile BankID. Swish works through a free smartphone appĬonsidering the fact that the service is actually supported by the banks where players hold accounts, you shouldn’t expect great delay in terms of payment processing. Just make sure you hold a bank account with one of the following banks, founding members included – Danske Bank, Handelsbanken, Länsförsäkringar, Nordea, SEB, Swedbank and Sparbankera, Forex Bank, ICA Banken, Skadia, Sparbanken Syd, Ålandsbanken – and get the Mobile BankID for confirmation purposes, and you’re good to go.

#SWISH PAYMENT SWEDEN ANDROID#

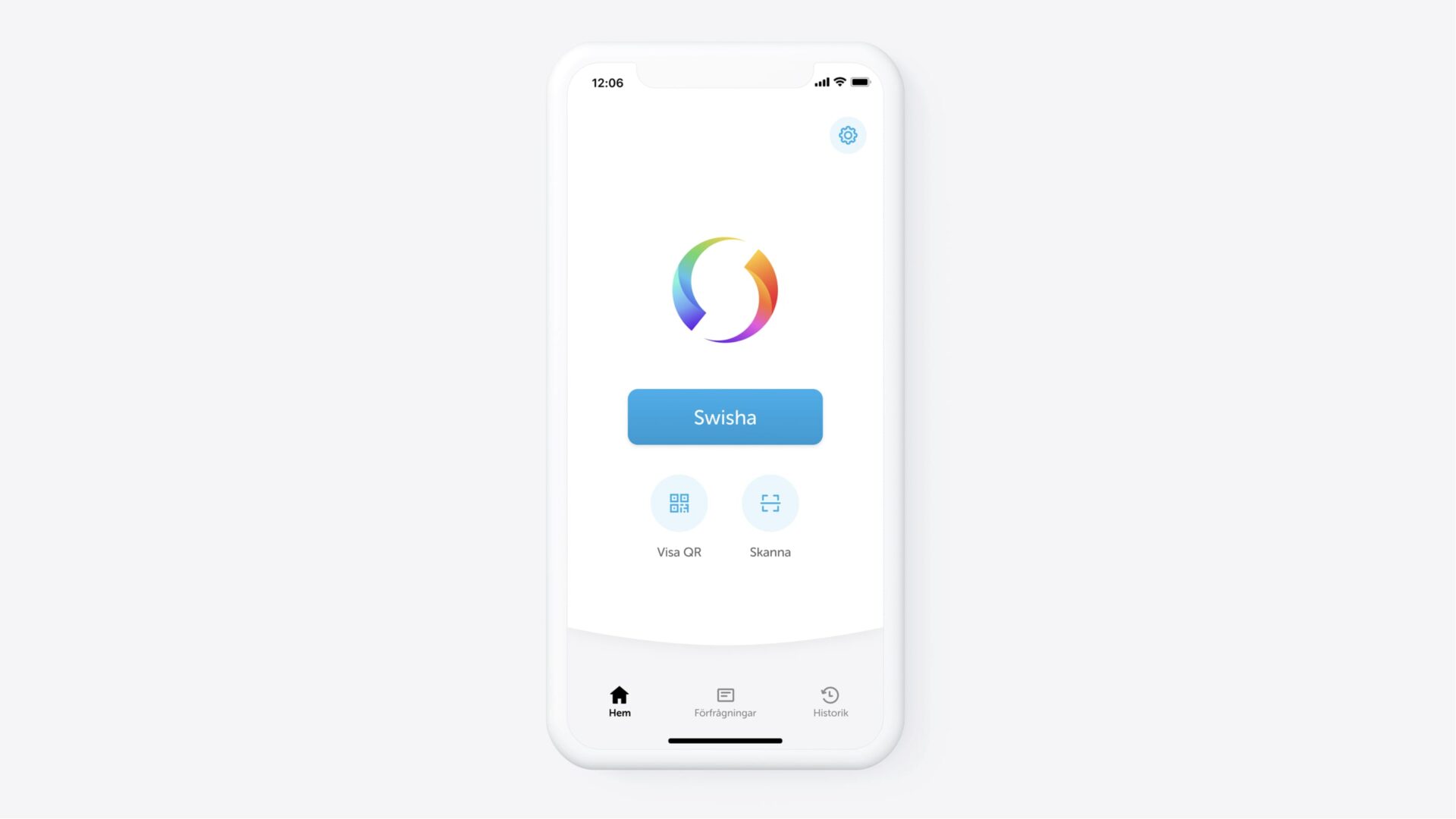

What made it even more attractive is the fact that it is optimized for the most common smartphone OSs – Android and iOS – with dedicated applications that can be downloaded from their respective app stores. With the company Getswish AB behind it, and a conjunction of the six leading banks in the country practically coming together for the foundation of the product, it has quickly risen to the top of popular online payment methods.

To make things clearer, the term ‘swishing’ came about from one of the latest Fintech solutions presented on the Swedish market – Swish. With the rise of e-commerce and a growing number of all sorts of merchants, many businesses ventured to get a piece of the pie, and those in Sweden are not far behind this endeavor either. Swishing someone is the new trend, and everyone is doing it – at least over half of the population in Sweden so far, which isn’t a small user pool as it is.

0 kommentar(er)

0 kommentar(er)